Are perovskites the future of solar energy?

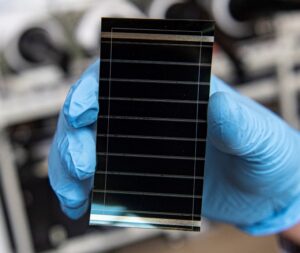

A perovskite solar cell (Photo credit: Dennis Schroeder / National Renewable Energy Laboratory)

Contributed by By Scott Graybeal, Caelux

2023 has been a significant year for solar power.

While insights from the year have yet to be analyzed, early US data demonstrates strong residential solar demand. Q1 installations reached 1,641 MWdc, a 30 percent year-over-year increase and a first-quarter record. The Federal Energy Regulatory Commission (FERC) reported that more new solar was installed in the United States in the first eight months of 2023 than any other energy source.

Utilities are also turning to solar technology to generate affordable, renewable energy. According to the U.S. Energy Information Administration, developers planned to install 29.1 GW of solar power in the United States in 2023, doubling the current record for installed utility-scale solar capacity in a single year.

With all this growth, it may be tempting for policymakers to assume that the market will evolve to usher in renewable energy solutions. The reality, however, is that governments will need to work closely with industry to ensure that the right technologies are deployed at scale and at the right time.

Accelerating our transition to clean energy grids necessitates thoughtful prioritization of solutions that can be easily manufactured domestically, coupled with longer-term technologies that require more research and development.

One such innovation lies within solar. Specifically, perovskites, a class of synthetic metal-halide nanomaterials, will significantly enhance solar energy capabilities in the coming years if the design and development challenges and hurdles and all renewable energy solutions that require cheap, green electrons can be navigated effectively.

Perovskites enhance existing solar solutions

The current solar market is shaped by silicon-based photovoltaic cells that have dominated the space since America invented the product in the 1950s and President Jimmy Carter installed solar panels on the White House roof in 1979.

This decades-old breakthrough has enabled the broad proliferation of solar power solutions, especially as the technology becomes more affordable. Today, the average rooftop solar system costs $25,000, down from $50,000 a decade ago.

There are several reasons why perovskites provide outsized value to solar, including:

- Material costs are readily sourced. No expensive or rare materials are needed.

- The capital equipment expense is low, as is the energy consumption required in production.

- They point to a future of super low cost, ultra-high efficiency solar produced regionally, extending benefits beyond energy production and environmental considerations to job creation and economic growth.

The global solar industry is currently constrained by extended supply chains, with the bulk of polysilicon production centralized in Asia, particularly China, which inherently sets a floor on cost reduction possibilities. Extracting incremental enhancements in crystalline silicon is increasingly challenging and costly, with the capital equipment required for advanced heterojunction techniques costing three times more than what’s needed for a perovskite production line with equivalent capacity.

Moreover, polysilicon production demands high temperatures, reaching over 1,000 degrees Fahrenheit, significantly impacting the energy needed for large-scale manufacturing. This high thermal requirement explains why polysilicon plants are often located near large coal mines in China. In contrast, perovskites can be processed at temperatures below 150 degrees Fahrenheit, presenting a direct advantage in energy consumption for scaling production.

GO DEEPER: Check out the Factor This! manufacturing playlist, including episodes on the U.S. solar manufacturing boom, thin-film manufacturing, and more. Subscribe wherever you get your podcasts.

This creates a market opportunity for innovation, and perovskites are the product that meets the moment, producing low-cost yet highly efficient solar devices that make traditional silicon modules more powerful and impactful.

They are more economically produced, less energy-intensive to process, and more automated and efficient in their manufacturing. Their versatility means they could be integrated into electric cars, building solar solutions, IoT gadgets, spacecrafts, and much more. They also hold promise in advancing rural electricity access.

Imagine a future where compact, mobile factories—perhaps no larger than standard shipping containers—can be dispatched to remote areas globally. These units could utilize regional resources to craft affordable and efficient solar panels. This vision depicts a transition from durable yet intricate solar setups to cost-effective, locally manufactured, and straightforward installations, free from intricate supply networks.

More importantly, perovskites improve the performance of silicon solar panels, producing 30% more power from the sun at a 10% lower cost than traditional panels.

Many industry experts believe that perovskites will outpace silicon as the primary material for solar cells within the decade. Manufactured in the US, perovskites could also help sidestep ethical labor concerns associated with some silicon-solar production and related supply chain uncertainties.

Still, there are challenges to address before perovskites can be widely commercialized, requiring ongoing research to ensure they remain competitive with current solar technologies.

Lessons learned from PV 2.0

Between 2005 and 2015, a period some call Cleantech 1.0 and PV 2.0, there was a pronounced emphasis on photovoltaic advancements. While a surge of investments followed, not all development theories held water.

The market gravitated towards crystalline silicon, predominantly from China, and to some extent, Cadmium-Tellurium (CdTe) solar technologies. Several ventures, like thin-film silicon and CIGS, faced setbacks due to a myriad of reasons, including:

- Technical limitations: Both CIGS and thin-film silicon encountered ceilings in efficiency gains relative to crystalline silicon. This shifted attention to cost-effectiveness, which became challenging given the requisite sophisticated infrastructures and high-end machinery.

- Equipment costs: Leading-edge machinery for thin-film silicon production was priced at around $1.00 per watt, potentially dropping to $0.85 per watt for the most competitive endeavors, excluding facility costs. Premier CIGS production setups hovered around $0.70 per watt for 100MW scales. On the other hand, China’s crystalline silicon sector continually slashed expenses, diving to figures as low as $0.15 per watt, covering the entire production process (some might account for polysilicon production as well).

- Collective determination: Many industry participants either failed to recognize China’s rapid progress or opted to overlook it. The drastic reduction in China’s module and silicon prices caught Western manufacturers off guard, dampening the prospects for concentrating PV and thin-film technologies.

Collectively, these experiences inform the ‘thin film hangover’ that has permeated the conversation regarding perovskites and have contributed to a somewhat timid response by Western governments to invest in scale development. Once again, China is making moves: there are already gigawatt scale announcements for 2024 for perovskite-based module technologies.

How to expand perovskite implementation

Perovskite nanomaterials are the new frontier in the realm of photovoltaic solutions. It’s imperative to understand that Western firms are pitted against formidable, technically proficient competitors on the global stage.

Instead of seeing this as a challenge, it should be our motivation. Already, we’ve witnessed perovskite modules effectively generate power at more economical rates. With such a foundation, Western perovskite pioneers can expedite its progression by:

Understanding the global landscape: Recognizing the global trajectory of technological advances is pivotal. Many Western perovskite initiatives and policymakers are content with crafting devices under one square meter – merely half of what’s needed for feasible commercial deployment, whether for four-terminal tandem or single junction usages. Western entities must transition from research to large-scale production as international adversaries scale up.

Encouraging practical testing: Advocating for outdoor trials of perovskite modules through government-backed and independent facilities is key. Additionally, initiating pilot trials in externally funded solar projects is essential. This is especially relevant in ensuring end users can validate, through real-world, third-party results that perovskites can support acceptable module lifetimes while delivering on the promise of cost reduction and performance enhancement,

Emphasizing skill development: The sector demands a team skilled in mechatronics, supply chain management, and factory functions. These positions offer attractive remunerations and pave the way for a manufacturing-centric economic shift.

Finally, the support federal and state policymakers are dedicating to advanced manufacturing will be a critical determinant of industry success.

Historically, the US thrived when rallying behind cohesive and agile industrial strategies, with iconic projects like the interstate highway network and the Apollo Mission serving as testimony. More recently, the Inflation Reduction Act (IRA), direct demand, loan guarantees, and state-driven incentives have galvanized sector innovation, development, and deployment of new ideas.

These trends and federal and state tax credits will significantly accelerate the United States’ ability to decarbonize. Solar power is critical to mitigating long-term climate change implications, growing energy independence and accessibility, and building up electrical grid resilience. Through key public-private partnerships, we can make meaningful gains toward a decarbonized future.

About the author

Scott Graybeal serves as CEO at Caelux, a pioneer in utilizing perovskites at scale to make solar energy more powerful and cost-effective, enabling the next generation of solar innovation. He is a veteran executive who previously led the Energy Solutions Segment at Flex Ltd (NASDAQ: FLEX), a $2B division within the company serving the solar, energy storage, and LED lighting markets. Under his leadership, Flex Energy Solutions grew 700%, became the #3 producer of PV modules outside of mainland China, and patented several key solar manufacturing innovations.