A Deep Dive into Global Green Hydrogen Policy Incentives

Governments across the world have reached a consensus: green hydrogen is key to transitioning away from fossil fuels.

US Secretary of Energy Jennifer Granholm has called hydrogen the “Swiss army knife of zero-carbon technologies,” highlighting its versatility and across-the-board capability to revolutionize heavy industry and agriculture, mobility, electricity generation, and more.

While green hydrogen and the technologies that enable it, namely fuel cells and electrolyzers, have existed for decades, hydrogen’s true potential is just now coming to the forefront. Recognizing green hydrogen’s potential, governments have begun passing policy incentives to pave the way for the global clean energy transition. These policies send a strong message to the market, underscoring how crucial green hydrogen is to achieve global mid-century decarbonization goals.

From the US to the European Union, spanning East and South Asia, as well as Oceania, governments have passed green hydrogen policies to help spur the growth of the green hydrogen market. These policies have the potential to generate as many as 30 million jobs by 2050.

Let’s look at a few of the policies that are shaping the future of green hydrogen.

US National Clean Hydrogen Roadmap

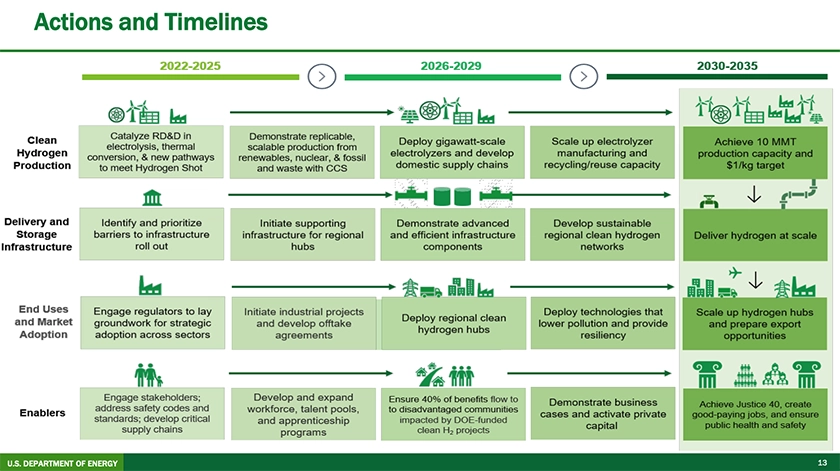

In June 2023, the US Department of Energy (DOE) published a first-in-kind policy report known as the “US National Clean Hydrogen Strategy and Roadmap.” This comprehensive strategy was created in response to a legislative mandate outlined under the Infrastructure Investment and Jobs Act (IIJA) of 2021.

In their report, the DOE states that the official US hydrogen strategy is to employ hydrogen for decarbonization across the entire value chain, from production, transportation via pipelines and other mechanisms, storage, and of course, for use across many applications. Simply put, the US has committed to scaling up the hydrogen industry across the board, with a specific focus on hard-to-decarbonize sectors, such as the industrial sector (e.g., methanol and ammonia) and heavy-duty transportation.

With a national goal of achieving net-zero emissions by mid-century, the Roadmap establishes concrete targets and market-driven metrics to measure national success and lead the US towards a cleaner, more sustainable energy future.

By 2030, the agency’s Roadmap envisions the US producing 10 million metric tons (MMT) annually. By 2040, the number for domestic production rises to 20 MMT and by 2050, the goal rises to 50 MMT.

What does 50 MMT mean? US Deputy Secretary of Energy David Turk said during an August 2023 webinar, it is the “equivalent not only to every bus and train but every plane and every ship in the US combined,” and it could lead to a 16% cut in US greenhouse gas emissions.

Under this plan, that could mean 100,000 new direct and indirect jobs by the 2030 goal and rising from there over subsequent decades, according to another agency report published in March 2023 titled “Pathways to Commercial Liftoff: Clean Hydrogen.”

The Roadmap comes in tandem with the passage of two key laws now serving as the bedrock of US hydrogen policy: the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA), the latter of which became law in 2022.

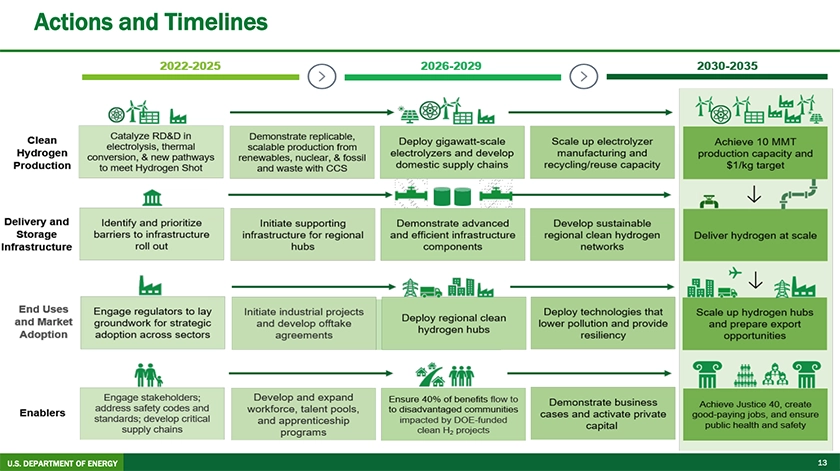

The IIJA creates federal funding for at least $8 billion in creating up to 10 regional hydrogen hubs and $9.5 billion total in sector investments at-large, including $1.5 billion to support the hydrogen electrolysis process employed in Plug’s fuel cells. Meanwhile, the IRA has created essential hydrogen production credits valued at up to $3/kg, akin to the production tax credits seen for other renewable energy sources.

To ensure the effective implementation of these hydrogen incentives as mandated in the legislation, the US government has established the Hydrogen Interagency Task Force. The task force consists of 11 different federal agencies, alongside the US Special Presidential Envoy for Climate. The creation of this taskforce underscores the significant role the US expects hydrogen to play in the global energy transition.

Across the US, states and local governments submitted applications to create regional hydrogen hubs boosted by the incentives outlined under the IRA. More accurately, these hubs are public-private partnerships between state and non-state actors. The Hubs program also helps demonstrate the need for fostering collaboration between states and industry to meet both long- and short-term goals in the development of the hydrogen market. The non-state actors, such as companies like Plug, along with labor unions and academic institutions, are leading efforts across the various hubs. Recently, the Biden administration announced the establishment of seven (out of the ten applications) hydrogen hubs, which are expected to attract more than $40 billion in private investment and generate thousands of jobs – bringing the total public and private investment in hydrogen hubs to nearly $50 billion, signaling a unified commitment to scaling up hydrogen.

The Roadmap must be updated every three years under the IIJA, offering continuous stakeholder feedback as the Roadmap morphs into widespread policy gains and builds a mass hydrogen market.

European Union’s REPowerEU Hydrogen Policy

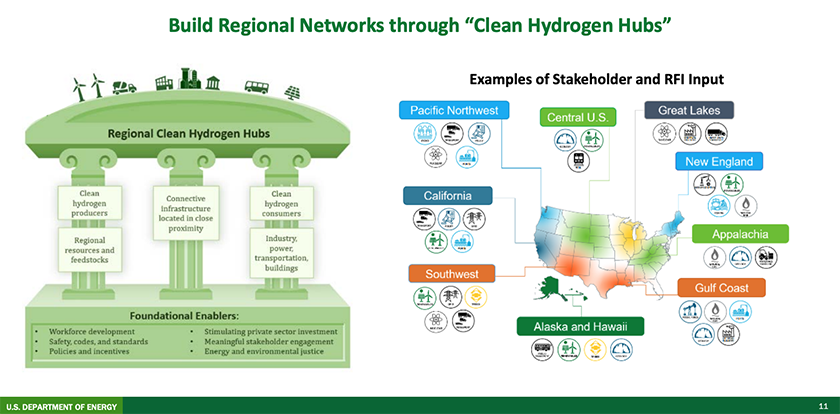

The EU also has an ambitious hydrogen policy agenda. The European Commission sets Europe’s Hydrogen strategy called “A hydrogen strategy for a climate-neutral Europe” in 2020. The Strategy listed a series of 20 key actions to be implemented in the Framework of the Fit for 55 Package. Since then, the EU took a step further by launching a series of additional initiatives on hydrogen fitting under the broader REPowerEU umbrella.

The policy package arose in light of Russia’s ongoing war with Ukraine, as the EU aimed to lessen its reliance on natural gas imports. This is also a response to Russia’s weaponization of its position as one of EU’s major energy exporters, causing an energy emergency across the EU, prompting it to address its regional energy security. Under the Hydrogen Accelerator plan, the European Commission intends to produce 10 MMT of hydrogen per year by 2030 and import the same amount by then, lessening the extent to which they need to rely on others for energy.

REPowerEU’s plan focuses on green hydrogen produced via the electrolysis process. In the EU, that is called renewable hydrogen as defined by the Commission Delegated Regulation. establishing a “Union methodology setting out detailed rules for the production of renewable liquid and gaseous transport fuels of non-biological origin”.

The launch of REPowerEU came mere months after the EU announced its Fit-for-55 plan, which calls for reducing greenhouse gas emissions within the EU by at least 55% by 2030. Fit-for-55 only calls for 10 MMT of green hydrogen consumption by 2030, meaning REPowerEU effectively doubled the green hydrogen goal. Further, Fit-for-55 calls for 40 gigawatts of renewable hydrogen electrolyzer capacity by 2030.

The two plans complement one another as the EU shifts away from natural gas.

“The combination of Fit-for-55 and REPowerEU is expected to initiate a virtuous circle that will likely both accelerate the transition and cut the EU’s reliance on Russian hydrocarbons,” wrote the consultancy KPMG. “On the one hand, full implementation of the Fit-for-55 proposals would lower gas consumption by 30% by 2030, consequently reducing hydrocarbon imports. On the other hand, REPowerEU may boost the Fit-for-55 proposals regarding earlier and more ambitious targets for renewable energy and energy efficiency.”

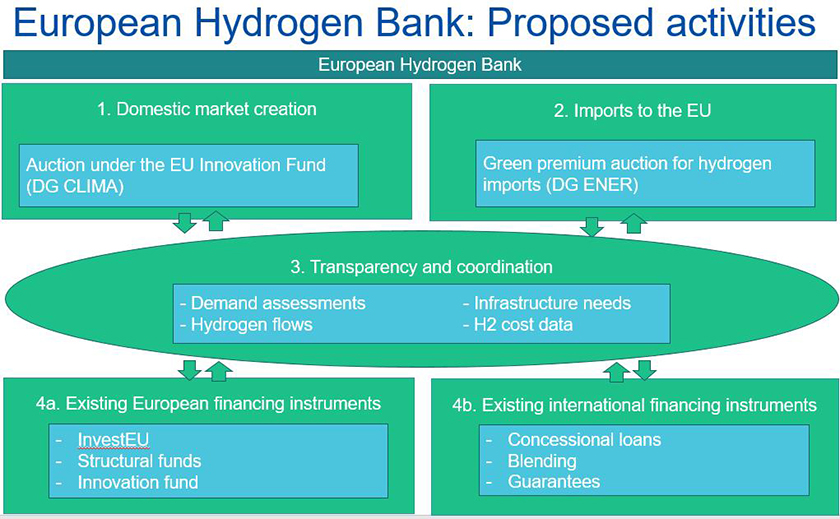

Like the US legislative packages that support the hydrogen buildout, the EU is also directing public financing to help scale-up the sector in the bloc. For example, the EU has allocated $3.18 billion from its Innovation Fund to launch the European Hydrogen Bank which aims to spur investment and increase demand for hydrogen. Notably, this EU subsidy is more generous than ones proposed in the US, offering up to $4.78/kg in hydrogen production credits for a 10-year period. It adds to the existing supporting schemes that can provide support to the sector although they are not Hydrogen-specific.

The European Hydrogen Bank (which is not a Bank) will provide $849 million in immediate financing via its first auction, slated for late-November 2023, with the money coming from the Innovation Fund, which itself gets its revenue from the EU’s carbon market.

Similar to the interagency task force model seen in the US, the EU has created a more informal Hydrogen Energy Network, which brings together the EU member states’ energy ministers for green hydrogen market development coordination. The European Commission has also placed 76 projects based in 16 different countries on its Important Projects of Common European Interest (IPCEI) hydrogen sector list. This list demonstrates[BL2] the EU’s level of priority and importance of supporting the growth of zero-emission energy projects and technologies that will help stimulate private investment in the hydrogen market over the long run. A project on the ICPEI is eligible for $13.2 billion in public funding and $16.8 billion in private financing, for a total of $29.9 billion. Two more announcement rounds remain forthcoming.

The IPCEI stems from a manifesto signed between EU member states in 2020, in which signatories, as the European Commission explains it, “agree[s] that projects should cover the full clean hydrogen value chain—from renewable and low-carbon hydrogen production to hydrogen storage, transmission and distribution, and hydrogen application, notably in industrial sectors.”

Like the hub model in the US, the EU has created a Clean Hydrogen Partnership—formerly known as the Fuel Cells and Hydrogen 2 Joint Undertaking—to create up to nine hydrogen valleys, providing subsidies of up to €105.4 million for their creation. These valleys are cross-border, integrating various regional governments to ensure the growth of a comprehensive, sustainable hydrogen ecosystem. The EU anticipates that the private sector will increase the financing available for these valleys by a multiple of five, amounting to over $636.7 billion going toward green hydrogen’s growth.

China’s Hydrogen Industry Development Plan

Compared to US and EU climate plans that span across decades, China’s Hydrogen Industry Development Plan works on a shorter timeframe. The Chinese Development Plan, introduced in March 2022 and runs through 2035, sets a goal of putting 50,000 hydrogen fuel cell vehicles on the road by 2025 and producing 100,000 to 200,000 MMT per year of green hydrogen by 2025.

Currently, China stands as the world’s leading hydrogen producer, yielding an impressive 33 MMT per year. According to the China Hydrogen Alliance, the country currently consumes 20 MMT of hydrogen annually, a figure projected to reach 35 MMT by 2030 and 60 MMT by 2050. As China strives for state-wide net-zero greenhouse gas emissions by 2060, hydrogen consumption is expected to surge to over 130 MMT, with 100 MMT being green hydrogen.

The South China Morning Press reports that all mainland China province, excluding Tibet, have agreed to unite forces to support the build-out of a robust green hydrogen infrastructure. Like the Hydrogen Task Force in the US, China’s state-backed and unified approach also extends to national administrative agencies, with 10 different agencies working under the Alliance, once again signaling to the market the crucial role hydrogen is expected to play in reducing carbon emissions.

While China’s hydrogen objectives aim for 2035 according to the existing policy framework, it will pursue its goals in five-year increments. By 2025, the overarching target is to lay the foundation for a domestic hydrogen supply chain and industry ecosystem, achieve renewable-based hydrogen production breakthroughs, establish transportation and storage infrastructure, and harness hydrogen from existing non-renewable sources.

S&P Global reported in March 2022, “by 2030, the plan aims to build a more comprehensive supply system for clean hydrogen and enable broad applications of hydrogen in different sectors to support China’s carbon peaking 2030 target. By 2035, the plan expects to have a more sophisticated ecosystem for hydrogen, covering diverse applications in transportation, energy storage, industrial and other sectors.”

An updated report published by the World Economic Forum in June, following the plan’s announcement, Alliance launched the Renewable Hydrogen 100 initiative, which aims to boost the capacity of green hydrogen electrolyzers to 100 gigawatts by 2030, ultimately producing 7.7 MMT of hydrogen annually.

Perhaps most notably, the country has already poured $20 billion into green hydrogen projects as well, demonstrating its commitment to strengthening the hydrogen economy.

Japan’s Hydrogen Society

In 2017, Japan became the first country in the world to launch a hydrogen plan, then known as the Basic Hydrogen Strategy. The comprehensive strategy focuses on Japan’s integration into the global hydrogen supply chain and becoming a hydrogen-centric society, encompassing several key goals/objectives.

The first goal is to increase hydrogen supply to 3 MMT by 2030, 12 MMT by 2040, and 20 million MMT by 2050. Second, Japan aims to attract $107.5 billion in hydrogen investments over the next 15 years. And third, the country seeks to increase green hydrogen production using Japanese-made electrolyzers to 15 gigawatts by 2030.

If realized, this “Hydrogen Society”, would apply hydrogen to the carbon-intensive steel-making process, and applications in hard-to-decarbonize sectors such as shipping and aviation. It also prioritizes green hydrogen, alongside other sustainable energy sources.

India’s National Green Hydrogen Mission

In 2023, India announced the launch of its National Green Hydrogen Mission, instantly making it a prominent leader in the global hydrogen market. Mirroring the objectives of the REPowerEU initiative, the National Green Hydrogen Mission aims reduce India’s reliance on imported fossil fuels while simultaneously boosting its domestic manufacturing capabilities.

By 2030, India aims to produce 5 MMT of green hydrogen per year and add 125 gigawatts of associated produced renewable energy into its inventory, creating an estimated 600,000 jobs. The country has allocated $2.4 billion into its initial financing pot for producing green hydrogen.

While the Rocky Mountain Institute has projected that India will produce a total 11 MMT of hydrogen by 2030, the Institute for Energy Economics and Financial Analysis concluded that the country’s hydrogen policy could yield $100 billion in outside investments.

Australia’s Hydrogen Headstart

Australia’s National Hydrogen Strategy, formulated in 2019, is currently in the midst of an overhaul inspired by the US IRA.

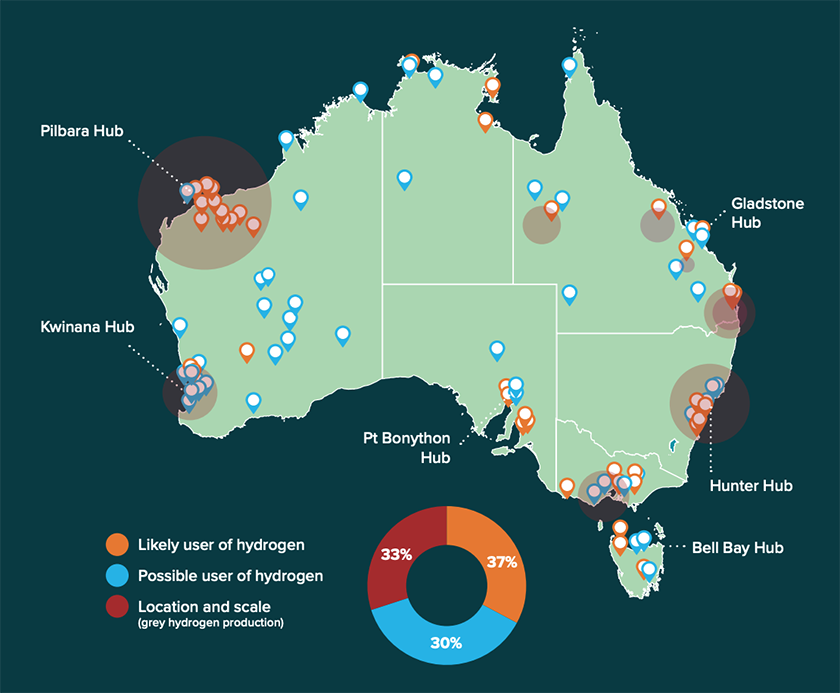

Australia sees hydrogen as “an important contributor” in achieving net-zero emissions and the development of which could create $192.7 billion in outside investments. The country aims to position itself on “a path to be a global hydrogen leader by 2030 on both an export basis and for the decarbonization of Australian industries.”

Under the initial 2019 Hydrogen Strategy, Australia has already made substantial investments. Over $321 million has been poured into five different hydrogen hubs and an additional $1.3 billion into a competitive hydrogen production program called Hydrogen Headstart.

Despite Australia’s latest hydrogen policy review in the works, the country was the world leader in green hydrogen production as of 2022. “Australia had the largest number of announced renewable hydrogen plants worldwide as of 2022; due to its abundant solar and wind resources, the country is expected to see some of the lowest levelized costs for producing renewable hydrogen by 2050,” a 2023 report by the organization Renewables Now detailed.

The International Energy Agency projects that Australia will lead the world in hydrogen exports by 2050 and be the second-ranking exporter by 2030.

Hydrogen Rising Globally

Green hydrogen incentives are on the rise and gaining global momentum, with countries learning from one another to collectively create a robust market for hydrogen, which is clearly essential in combating climate change.

As a global company, Plug stands ready to partner with governments and industry to ensure the ambitious visions for green hydrogen, supplemented by unprecedented transcontinental financial support, becomes reality. Plug has the expertise and capabilities that span across the green hydrogen across the value chain, from manufacturing electrolyzers, fuel cell technology, liquefaction tanks, and refueling stations, and having the ability to service battery electric vehicle charging stations. This comprehensive skill set positions Plug as a vital partner in the worldwide effort to advance the green hydrogen agenda and address the urgent challenge of climate change.

To learn more about what we do and how we can help you achieve your green hydrogen goals, please contact one of Plug’s products team. We look forward to hearing from you and working together!