Feds announce $4B in tax credits for supply chain, decarbonization

(Photo by 金 运 on Unsplash)

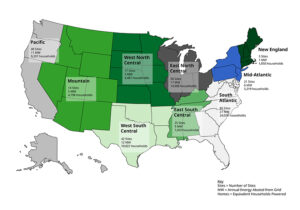

The U.S. Department of Energy (DOE), the U.S. Department of Treasury, and the Internal Revenue Service (IRS) announced $4 billion in tax credits for over 100 projects across 35 states towards accelerating domestic clean energy manufacturing and the decarbonization of industrial facilities.

Projects selected for tax credits under the Qualifying Advanced Energy Project Tax Credit (48C), funded by the Inflation Reduction Act, span across large, medium, and small businesses and state and local governments, all of which must meet prevailing wage and apprenticeship requirements to receive a 30% investment tax credit.

“From direct grants to historic tax credits, the President’s Investing in America agenda is making the nation an irresistible place to invest in clean energy manufacturing,” said U.S. Secretary of Energy Jennifer M. Granholm. “The President’s agenda places direct emphasis on communities that have traditionally powered our nation for generations, helping ensure those communities reap the economic benefits of the clean energy transition and continue to play a leading role in building up the next wave of energy sources.”

Established by the American Recovery and Reinvestment Act of 2009, the 48C Program was expanded with a $10 billion investment under the Inflation Reduction Act of 2022. At least $4 billion of the total $10 billion will be allocated for projects in designated 48C energy communities — communities with closed coal mines or coal plants. The 48C Program provides an investment tax credit of up to 30% of qualified investments for certified projects that meet prevailing wage and apprenticeship requirements.

For the first round of the 48C Program, applicants submitted concept papers seeking nearly $42 billion in tax credits across all categories of projects, including nearly $11 billion for projects in designated energy communities census tracts. DOE says it received approximately 250 full applications from projects requesting $13.5 billion in total tax credits. There was variety in the size and scope of projects, with applicants requesting tax credits ranging from under $1 million to over $100 million.

Clean energy manufacturing and recycling: $2.7 billion in tax credits (67% of round 1 tax credits)

- Selected from applications requesting support for the buildout of U.S. manufacturing capabilities for clean energy deployment and span clean hydrogen (electrolyzers, fuel cells, and subcomponents), grid (cables, conductors, transformers, and energy storage), electric vehicles (battery components, power electronics), nuclear power, solar PV, and wind energy (including offshore wind components), among other industries and components.

Critical materials recycling, processing, and refining: $800 million in tax credits (20% of round 1 tax credits)

- Selected projects are investing in multiple electrical steel applications, lithium-ion battery recycling, and rare earth projects.

Industrial decarbonization: $500 million in tax credits (13% of round 1 tax credits)

- Selected projects would implement decarbonization measures across diverse sectors, including chemicals, food and beverage, pulp and paper, biofuels, glass, ceramics, iron and steel, automotive manufacturing, and building materials. Low-carbon fuels, feedstocks, and energy sources are well-represented as a solution for decarbonization across these projects.

For selected projects to receive the tax credit, information will need to be submitted to the 48C portal within two years to certify the project. Within an additional two years following project certification, the project must be placed in service.