Unpacking the Future: Plug’s 7.5 GW Basic Engineering and Design Package Contracts

Since introducing the Basic Engineering and Design Package (BEDP) offer just two years ago, Plug’s electrolyzer business has experienced remarkable growth. With total BEDP global contracts reaching 7.5 GW, the momentum is undeniable. This milestone not only highlights the increasing demand for green hydrogen but also underscores the importance of Plug’s experience in electrolyzer technology in driving the green hydrogen revolution. Let’s break it down and explore the BEDP approach and what it means for the industry and Plug.

What is a BEDP?

The BEDP provides the engineering and plant integration details to allow a full plant front-end engineering design (FEED) study to proceed purposefully and efficiently to understand, in detail, the capital and operating expenditures associated with running a potential plant.

The BEDP approach enables Plug’s customers to seamlessly integrate the electrolyzer package into the project’s broader engineering and construction plan. Customers also benefit from Plug’s experiences building its own plants and sharing lessons learned as the only electrolyzer OEM supplier building green hydrogen plants.

The BEDPs contain all the information for a clients’ FEED project phase to develop a mature project execution plan and financial models required to bring the projects to Final Investment Decision (FID).

Plug’s comprehensive design framework for a liquid hydrogen plant, is centered around its portfolio suite of products. This includes Plug’s PEM electrolyzers, liquefiers, cryogenic storage solutions, and both liquid and high-pressure gas tube trailers for transport. Plug is the only company to offer this turnkey solution.

What do developers consider when vetting an electrolyzer supplier?

There are various key factors that a company considers when vetting electrolyzer manufacturer and evaluating the viability of a project during the BEDP.

- Integration Engineering/Project Management Capabilities: Project developers should consider whether the project gets done on time, on budget, and most importantly, at all, and whether the project will work as they have intended. Having the know-how, experience, and reputation for working through issues is therefore critical when choosing an electrolyzer partner as opposed to just a supplier.

- Operating History: The electrolyzer partner having verifiable operating history at scale greatly increases the probability of the electrolyzer performing to its stated specifications, and the comprehensive offering meeting expectations. Without verified operating data, availability of the project can suffer significantly.

- Power Cost Optimization Know How: Depending on geography and power source, power costs can be optimized with variances of $20+/MWh (using demand response, technology selection, etc.). Companies with experience in building and owning hydrogen plants can provide guidance, with potentially significant savings on power cost.

- Total Plant Cost: The total plant cost is a better metric for comparing electrolyzer provider’s system. This is due to different electrolyzers having varying ease of installation requirements (such as modularity and module size), different scope, readily available documentation, and the company’s overall experience in installing and building electrolysis plants.

- Electrolyzer Cost: Electrolyzer cost is important to understand, but only after understanding its context within the Total Installed Cost of an electrolyzer plant, as electrolyzers typically only account for 30% of total plant costs. Variances in electrolyzer costs of different providers (typically US/EU vs China), up to $400/kW can, but minimally affect, levelized cost of hydrogen (LCOH).

- Energy Efficiency of the Electrolyzer system: Power costs account for 50+% of the cost of hydrogen production and are easiest to compare against different electrolyzer providers, however the gap from the least to most efficient electrolyzers is small, and often does not account for the full plant scope, therefore the effect on LCOH is minimal compared to other factors.

Plug’s industry leading position in PEM electrolyzer manufacturing at our Rochester, NY Gigafactory and the systems integration know how of Plug Process Systems (Formerly Frames), combined with Plug’s proven project execution and operation at our Woodbine, Georgia facility give the company a unique value proposition to offer to customers evaluating hydrogen projects and going through their FEED work.

Converting the pipeline

Following the significant project development work and completion of FEED and BEDP activities, customers will select suppliers and look to secure financing to reach FID. The maturity and track record of chosen technologies and suppliers is a key part of the bankability of any green hydrogen project looking to reach FID.

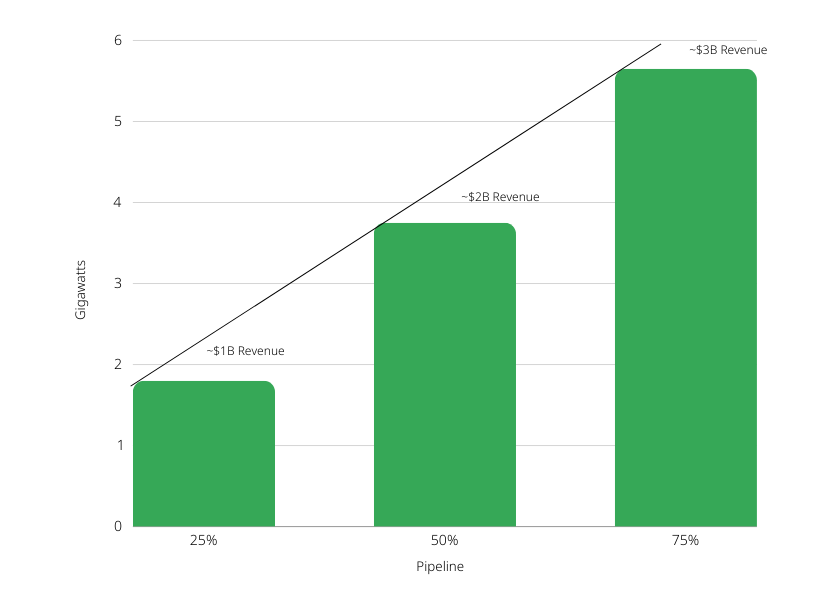

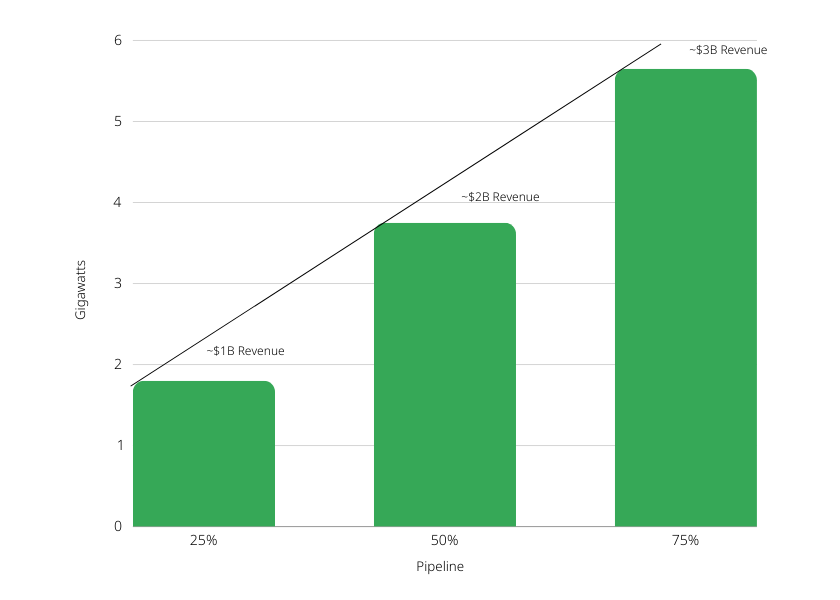

With 7.5 GW of BEDPs in process, the general timeline for these projected to move to financing and FID is approximately 6-18 months. At that point, the BEDP funnel could translate into hardware sales, with each GW representing up to $0.5B to $0.75B in revenue.

The introduction of Plug’s Basic Engineering and Design Package (BEDP) has significantly propelled the growth of its electrolyzer business, exemplified by reaching 7.5 GW in global contracts within just two years. As the only company offering these end-to-end solutions, Plug has a unique opportunity in this market. The potential equipment sales for a facility with a capacity of 30 tons per day, represents a sales opportunity of approximately $130 million and Plug has the experience, proven technology, and drive to deliver on this opportunity.