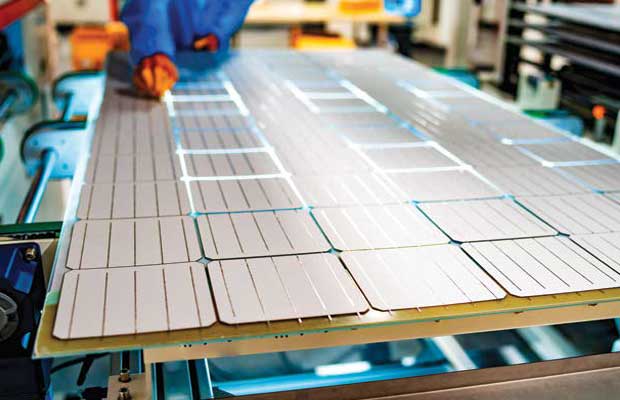

Vietnam emerges as solar manufacturing powerhouse with Chinese help

Vietnam Favoured By Chinese Solar Firms- 14 GW MoU For Solar Panels Signed In Latest Deal

In a clear indication of the advantage it offers versus other South East Asian nations for Chinese firms, Vietnam saw the signing of yet another Memorandum of Understanding (MoU) for a 14 GW solar panel project, to be built in two phases. Signed between Hoang Thinh Dat JSC and Chinese firm Hainan Drinda New Energy Technology Co., Ltd. the new plant is expected to come up in the central province of Nghe An.

Hainan Drinda New Energy has indicated plans for a designed capacity of 14GW, divided into two phases, covering an area of 50 hectares in Hoang Mai II Industrial Park in the central province.

The project is expected to receive an investment of about $450 million for the first phase, slated for completion by the end of this year.

Hainan Drinda joins a clutch of Chinese solar majors that have favoured the Vietnamese market as a manufacturing option to target many markets where restrictions on Made-in-China modules are springing up, notably the US. China-based firms are estimated to hold at least 60 per cent of the market share for photovoltaic modules in Vietnam, with prominent names like Vina Solar, JA Solar, Jinko Solar, and Trina Solar.

The world’s number 1 module make by shipments, Jinko Solar which already manufacturers modules at a 7 GW plant in Vietnam, has announced plans to move ahead with the Jinko Solar Hai Ha Vietnam Photovoltaic Cell Technology Complex project with a total investment of $1.5 billion.

Another module major, Trina Solar Cell Co., Ltd. has also been awarded an investment registration certificate for a project in the northern province of Thai Nguyen worth $454 million to produce solar modules and batteries.

Trina Solar Cell had previously built two projects with a total registered investment capital of $478 million to produce photovoltaic cells for solar batteries, silicon bars and monocrystalline silicon panels.

Cumulative investment by Chinese firms in Vietnam’s manufacturing abilities is slated to cross $2.5 billion by this time in 2025, ensuring the country remains a key part of the global supply chain into the near future.

Solar inverter maker GoodWe had also picked Vietnam to start its first overseas manufacturing base recently